How to Pick the Right Medicare Advantage Strategy for Your Needs

Navigating the complicated landscape of Medicare Benefit plans can be a daunting task for several individuals seeking to make the most effective selection for their healthcare requires. With a myriad of options readily available, each strategy includes its one-of-a-kind collection of advantages, expenses, and supplier networks that must be carefully considered and taken into consideration. Comprehending exactly how to assess your specific medical care demands, analyze the various strategy alternatives, and comparing coverage and prices can be overwhelming. With the ideal guidance and understanding, making an educated choice that aligns with your demands is not just possible however essential for making sure extensive and customized health care coverage.

Assessing Your Medical Care Needs

When thinking about a Medicare Advantage plan, it is critical to first assess your specific medical care needs extensively. If you prepare for needing specific treatments or surgical procedures in the coming year, ensure that the plan you select covers those services.

:max_bytes(150000):strip_icc()/Primary-Image-pitfalls-medicare-advantage-plans-e0b4733752d84973b8baad075834c35a.jpg)

Understanding Strategy Options

:max_bytes(150000):strip_icc()/Primary-Image-pitfalls-medicare-advantage-plans-e0b4733752d84973b8baad075834c35a.jpg)

Comparing Protection and Costs

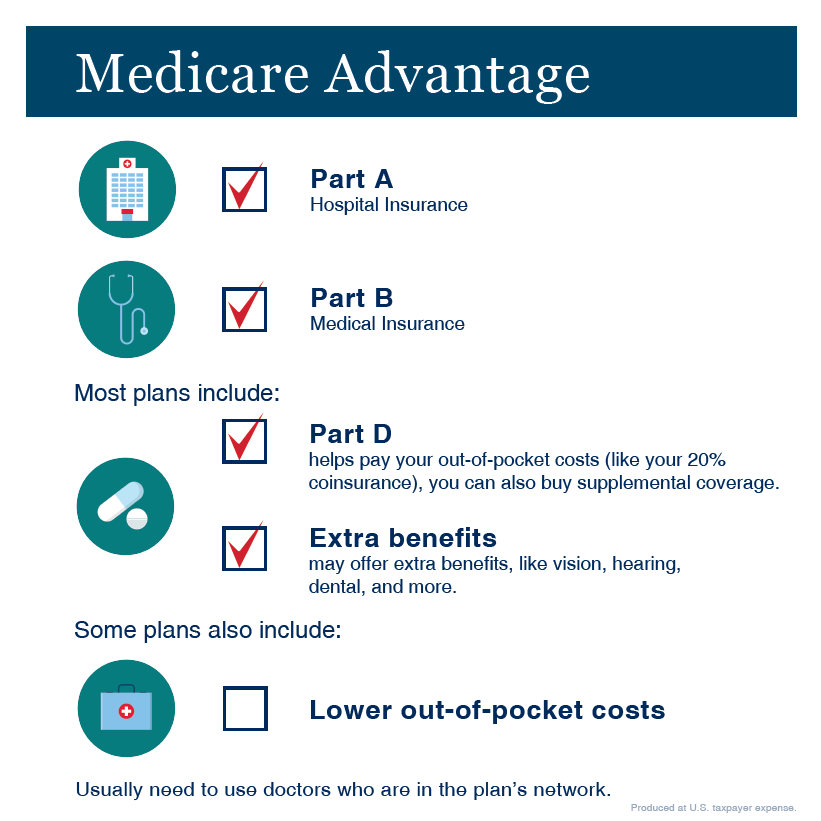

In examining Medicare Advantage prepares, it is important to compare the insurance coverage and prices supplied by different strategy options to make an educated choice tailored to your health care demands and financial considerations (Medicare advantage plans near me). When contrasting insurance coverage, look at the services consisted of in each strategy, such as healthcare facility keeps, doctor check outs, prescription medicines, and fringe benefits like vision or dental care. Examine whether the strategies cover the details medications you require and if your favored physicians and doctor are in-network

Similarly crucial is reviewing the prices related to each strategy. Contrast costs, deductibles, copayments, and coinsurance quantities. Take into consideration the optimum out-of-pocket restriction, which is one of the most you would certainly need to pay in a year for protected services. Comprehending these expenses can assist you estimate your potential healthcare costs under each plan.

Eventually, choosing the ideal Medicare Advantage plan includes striking a balance between extensive coverage and manageable costs. By carefully comparing insurance coverage and prices, you can pick a plan that best fulfills your health care requires while aligning with your budgetary constraints.

Reviewing copyright Networks

To make an informed choice when picking a Medicare Advantage strategy, it is vital to assess the supplier networks readily web link available under each strategy. Provider networks refer to the doctors, healthcare facilities, and various other medical care More about the author providers that have contracted with the Medicare Advantage plan to offer services to its participants. Remember that out-of-network solutions might not be covered or might come with greater out-of-pocket expenses, so selecting a plan with a network that satisfies your requirements is important for optimizing the advantages of your Medicare Advantage coverage.

Evaluating Fringe Benefits

When analyzing Medicare Benefit prepares, it is vital to meticulously assess the auxiliary advantages used beyond basic clinical insurance check these guys out coverage. Medicare advantage plans near me. These fringe benefits can differ extensively among different strategies and can consist of services such as vision, oral, hearing, health and fitness programs, transportation to medical appointments, and also protection for non-prescription medicines

Prior to choosing a strategy, consider your individual medical care needs to establish which fringe benefits would be most helpful to you. For example, if you put on glasses or call for dental job on a regular basis, a plan that consists of vision and dental insurance coverage would be advantageous. Likewise, if you require help getting to medical consultations, a plan that supplies transportation solutions could be valuable.

Reviewing the added advantages offered by Medicare Benefit plans can assist you choose a plan that not just covers your fundamental medical requirements yet likewise supplies additional solutions that straighten with your healthcare demands. By meticulously assessing these supplementary benefits, you can pick a strategy that offers detailed coverage tailored to your specific needs.

Final Thought

Finally, picking the appropriate Medicare Advantage plan needs mindful factor to consider of one's healthcare requirements, plan choices, protection, prices, copyright networks, and fringe benefits. By evaluating these aspects completely, people can make an enlightened choice that straightens with their specific needs and choices. It is important to conduct comprehensive research study and compare various plans to guarantee the chosen plan will properly satisfy one's healthcare demands.